Market Update: November 2023

Published

December 14, 2023

Category

Market Insights

Reading Time

9 MINS

by Vision Wealth Partners

Quick Hits

- Markets Rebound in November

- Strong Month for Fixed Income

- Signs of Soft Landing

- Risks Remain Despite Market Rally

- Outlook Remains Positive

Markets Rebound in November

Equity markets surged in November, offsetting losses from the prior three months. All three major U.S. indices were up notably for the month. The S&P 500 gained 9.13 percent while the Dow Jones Industrial Average (DJIA) rose 9.15 percent. The technology-heavy Nasdaq Composite led the way, with a strong 10.83 percent return in November. Equities benefited from falling interest rates throughout November, which helped drive valuations up during the month.

Stock market fundamentals also showed signs of improvement during the month. According to Bloomberg Intelligence, as of November 30 with 98 percent of companies having reported actual earnings, the blended earnings growth rate for the S&P 500 in the third quarter stood at 4.5 percent. This is up from the estimated 2.8 percent growth rate at the end of October and well above analyst estimates at the start of earnings season for a 1.2 percent decline in earnings. This marks the first quarter with year over year earnings growth since the third quarter of 2022, which is an encouraging sign. Over the long run fundamentals have driven market performance so the return to earnings growth was a boon for investors.

Technical factors rebounded along with markets in November, as all three major U.S. indices finished the month well above their respective 200-day moving averages. This was especially encouraging for the S&P 500 and DJIA, both of which ended October below trend. The 200-day moving average is a widely followed technical signal, as prolonged breaks above or below this level can signal shifting investor sentiment for an index. The fact that both the S&P 500 and DJIA were able to finish the month above trend after failing to do so in October is a positive sign that the earlier technical weakness was short-lived and not the start of a downward trend for those indices.

The story was much the same internationally during the month, as falling rates helped support international stock market valuations. The MSCI EAFE index rose 9.28 percent during the month while the MSCI Emerging Markets index was up 8.02 percent. These rallies helped bring both the developed and emerging market indices above their respective 200-day moving averages for the month, marking the first month with both indices finishing above trend since July.

Strong Month for Fixed Income

Fixed income markets also benefited from falling interest rates during the month. The 10-year U.S. Treasury yield fell from 4.77 percent at the start of the month to 4.37 percent at month-end. The large drop in long-term rates during the month was due to a combination of slowing economic growth and rising investor belief that the Federal Reserve (Fed) is unlikely to hike short-term interest rates further. Short-term interest rates also fell in November, a sign that investors believe the Fed may start cutting rates at some point in 2024. The Bloomberg Aggregate Bond index gained 4.53 percent in November, bringing the index to positive territory for the year.

High-yield fixed income was also up for the month. The Bloomberg U.S. Corporate High Yield Index also gained 4.53 percent in November. High-yield credit spreads dropped from 4.47 percent at the start of the month to 3.80 percent at month end. Falling credit spreads are a sign that investors were willing to accept lower yields for investing in relatively riskier high-yield bonds during the month.

Signs of Soft Landing

The main driver of the positive market performance during the month was the notable fall in interest rates in November, which in turn was caused by signs that the economy is slowing and may be approaching a soft landing. We’ve seen reports of solid yet slowing growth for several months now, and the economic data releases in November seemed to confirm a path of slower yet potentially more sustainable growth ahead.

Hiring slowed in October but fell to normal pre-pandemic levels, as a historically solid 150,000 jobs were added during the month. Consumer confidence stabilized during the month and personal income and spending continued to grow, albeit at a slower rate than earlier in the year.

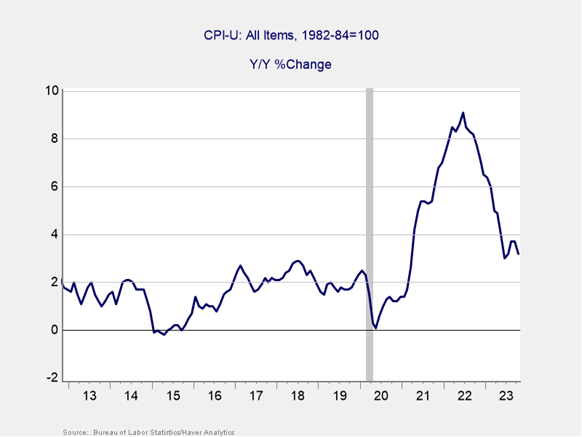

Inflation also showed encouraging signs of slowing growth during the month, as headline consumer price growth fell from 3.7 percent in September to 3.2 percent in October. As you can see in Figure 1 below, headline consumer price growth now sits at the second-lowest level in the past two years and well below the recent high of 9.1 percent that we saw in June 2022.

Figure 1: Consumer Price Index Year-Over-Year Percentage Change, November 2012-Present

Source: Bureau of Labor Statistics/Haver Analytics

One of the major questions for the economy and markets this year was if tighter monetary policy from the Fed would successfully lower inflation without bringing the economy into a recession. Based on the recent updates it seems that the economy is heading toward a soft landing, which is a good sign for investors as slower growth and lower inflation is the target outcome that the Fed has been working toward throughout the course of the year.

Inflation and the Fed will continue to be worth monitoring as there is still real work to be done to get inflation back down to the Fed’s 2 percent target. The updates in November showed we are on the right path. Looking forward, the economic slowdown, along with continued weakness in the housing sector, is expected to contribute to further improvements on the inflation front.

The Takeaway

- Signs of continued slowing economic growth in November.

- Progress combating inflation points toward the prospects of a soft landing.

Risks Remain Despite Market Rallies

Despite the positive month for the economy and markets there are real risks that remain to the outlook.

We may see an increase in inflation in the months ahead, especially if volatile food and energy prices rise. Additionally, it’s possible that the slowdown will accelerate, and we could see a more challenging economic backdrop for markets in 2024. While neither of these scenarios appear to be the most likely outcome at this time, they are both worth monitoring given the impact they can have on markets.

Geopolitical risks are also worth paying attention to given the rise in uncertainty that we’ve seen this year. The continued conflicts in Ukraine and the Middle East have the potential to lead to further regional instability and could negatively impact global markets if there is further escalation. The slowdown in China is another area to monitor as we head into the new year due to the importance of the country for global growth.

And, of course, there are always the unknown risks that could pop up at any time to negatively impact investors. As we saw earlier this year with the regional bank failures and potential government default, these risks can appear suddenly and have a meaningful short-term impact on markets.

The Takeaway

- Inflation and the Fed are real risks for investors despite the progress we’ve seen this year.

- Rising geopolitical uncertainty should be monitored as we head into the new year.

Outlook Remains Positive

Despite the real risks that remain, the outlook for markets and the economy remains positive. The return to earnings growth in the third quarter was an encouraging sign that businesses were able to take advantage of the positive economic background during the period. The drop in interest rates last month should only help going forward as lower rates feed into valuations and provide lower financing costs for businesses and consumers.

While we have seen signs of slowing economic growth, the reports largely paint the picture of a soft landing rather than an imminent recession. Markets reacted positively to the signs of slower but potentially more sustainable growth during the month, and we may see further market appreciation to finish out the year given the positive momentum heading into December.

Ultimately the economic and fundamental backdrop for markets appears to be in a sweet spot, with a soft landing and a return to earnings growth setting the stage for potentially positive performance ahead.

That said, short-term risks remain to the market and economy that could lead to further volatility. It’s important to remember that short-term market disruptions are a normal part of the market cycle and that successful financial planning consists of creating well-diversified portfolios that are set to withstand various market environments.

As the Nobel Prize-winning economist Harry Markowitz once reportedly quipped, “Diversification is the only free lunch,” in investing. While diversification does not assure a profit or protect against loss in declining markets, nor can it guarantee that any objective or goal will be achieved, we believe creating portfolios that take advantage of the benefits of diversification and match investor goals with timelines, investors can withstand periods of short-term volatility and benefit in rising markets. As always, if concerns remain you should speak to your financial advisor to discuss how your financial plan can help your portfolio withstand uncertain times.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

###

Vision Wealth Partners is located at 9881 Broken Land Parkway, Suite 220, Columbia, MD 21046, and can be reached at 410.910.9740. Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

© 2023 Commonwealth Financial Network®