Market Update: July 2022

Published

August 15, 2022

Category

Market Insights

Reading Time

8 MINS

by Vision Wealth Partners

Markets Rebound in July

It was a strong start to the second half of the year for markets, with all three major U.S. indices experiencing gains in July. The S&P 500 rose 9.22 percent while the Dow Jones Industrial Average (DJIA) notched a 6.82 percent return. The technology-heavy Nasdaq Composite led the way with a 12.39 percent return, marking the best month for the index in more than two years. Although all three indices are still in red for the year, these results helped to offset some second quarter losses.

Fundamentals showed signs of positive progress during the month as well. Per Bloomberg Intelligence, as of July 29, 2022, with 56 percent of companies having reported actual earnings, the blended earnings growth rate for the S&P 500 in the second quarter was 6.6 percent. This is up from analyst estimates for a more modest 4.1 percent increase at the start of earnings season and signals continued fundamental improvement for U.S. businesses during the quarter. Fundamentals drive long-term market performance, so the second quarter’s better-than-expected results so far are an encouraging sign for markets.

While fundamental factors were supportive, technical factors were not. All three indices spent the entire month well below their respective 200-day moving averages—for the fourth consecutive month below trend—and the rebound in July was not enough to offset weakness from earlier in the year. The 200-day moving average is a widely monitored technical indicator because prolonged breaks above or below this level can signal shifting investor sentiment for an index.

The story was more mixed for international markets. The MSCI EAFE Index increased 4.98 percent in July with developed international markets experiencing a similar rebound as the major U.S. indices to start the second half of the year. The MSCI Emerging Markets Index, on the other hand, dropped 0.16 percent during the month as concerns about slowing growth in China and other emerging market economies weighed on investor sentiment. Technical factors continued to serve as a headwind for international equities in July. Both indices spent the month well below their respective 200-day moving averages and have finished every month this year below trend, signaling investor unease with international stocks.

Even fixed income markets saw notable rebounds in July, driven by falling long-term interest rates. The 10 year U.S. Treasury yield dropped from 2.98 percent at the end of June to 2.67 percent by the end of July, due primarily to investor concerns about slowing economic growth. This brought long-term interest rates to their lowest level in just over three months, which helped support both equity and fixed income markets. The Bloomberg U.S. Aggregate Bond Index gained 2.44 percent in July.

High-yield fixed income markets also showed signs of improvement in July. The Bloomberg U.S. Corporate High Yield Index gained 5.90 percent during the month. High-yield credit spreads declined from 5.92 percent at the start of the month to 4.83 percent by month-end, signaling less investor concern surrounding credit risk in the high-yield market.

Slowing Growth and Recession Concerns

Economic data releases in July largely pointed toward slowing growth. The release of the advance estimate for second quarter gross domestic product (GDP) growth toward month-end marked two consecutive quarters with declining growth, which led to increased investor concern of a potential recession.

While two negative quarters of GDP growth generated headlines and drew attention, it’s important to note that a formal recession is more complicated than simply looking at quarterly GDP growth figures; by that definition, we’re not currently in a recession. Additionally, when looking at what led to the slowdown in growth during those quarters, it becomes clear that negative outcomes were largely driven by technical adjustments caused by the aftermath of the Covid-19 pandemic. Traditional drivers of economic growth, such as job creation and personal consumption, remained solid during the first half of the year and indicate that economic fundamentals are healthier than the headline GDP reports would suggest.

For example, the June job report showed that 372,000 jobs were added during the month, which is well above economist estimates and very strong on a historical basis. The unemployment rate remained unchanged at 3.6 percent, which tied the post-pandemic low and signals high levels of overall employment throughout the economy. Additional job openings and voluntary quit rates remain high, which again signals high levels of labor demand and a robust job market.

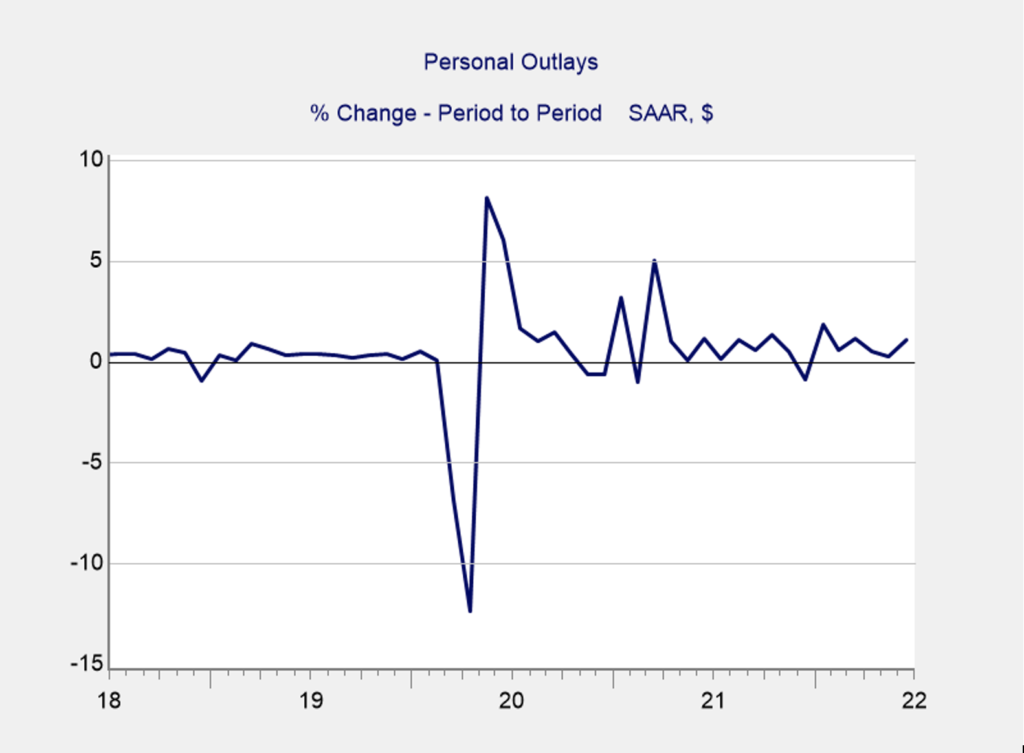

Consumer spending also showed signs of growth during the month. Retail sales rebounded in June, with both headline and core sales increasing by more than expected. This was echoed by June’s personal income and spending reports, which showed that consumers earned and spent more than anticipated. As you can see in Figure 1, this marks six consecutive months with personal spending growth following a temporary lull in spending at the end of last year.

Figure 1. Personal Spending Growth, July 2018–Present

Source: Bureau of Economic Analysis / Haver Analytics

Consumer spending growth in June and throughout the first half of the year was especially notable given the declining confidence we saw during that period. High inflation, rising gas prices, and market selloffs all contributed to the drop in confidence to start the year, but there are reasons for optimism. Gas prices are down compared to their recent peak in mid-June, and there are other signs that inflation may be peaking as the Federal Reserve (Fed)’s attempts to slow the economy appear to be taking hold. While risks to consumer spending growth certainly remain, the bulk of that risk is likely behind us for the time being and there is potential for even faster growth toward the end of the year if inflation starts to fade.

Business spending also showed signs of continued growth during the month with better-than-expected headline and core durable goods orders growth. While business spending growth has slowed compared to last year when businesses were investing heavily due to reopening efforts, business spending remains solid and indicates that business owners are continuing to invest to try and meet high levels of demand.

Growth Expected Despite Market Risks

July was a positive month for markets, as returns helped offset some losses from early 2022. The better-than-expected second quarter earnings results are an encouraging sign that businesses continued to successfully improve their fundamentals in the first half of the year. Economic releases also gave reasons for optimism looking forward, as they largely showed that economic fundamentals remain strong despite headwinds created by high inflation levels.

The most likely path forward is continued growth for markets and the economy in the months ahead; however, very real risks to that outlook remain. Domestically, the major concern is still inflation, which could lead to further market turbulence if inflationary pressure remains stubbornly high. Additionally, while medical risks have largely declined from their peak, we could still face another wave of Covid-19 infections, which might negatively impact the economy and markets.

Looking abroad, slowing global growth and political uncertainty remain a potential cause for concern for U.S. investors. For example, the ongoing war in Ukraine could expand and lead to further instability if fighting intensifies, which could prompt unexpected market volatility. There are also concerns about China’s zero-Covid-19 policies and the potential impact on global trade if these policies persist for the foreseeable future.

Ultimately, despite risks to both the economy and the markets, the most likely path forward is growth—albeit slower growth than we’ve seen since reopening efforts began in earnest last year. We’re likely to experience setbacks and turbulence along the way, but economic fundamentals are solid and should help support long-term growth. Given the potential uncertainty in the short term, a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

###

Vision Wealth Partners is located at 9881 Broken Land Parkway, Suite 220, Columbia, MD 21046, and can be reached at 410.910.9740. Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®.

© 2022 Commonwealth Financial Network®